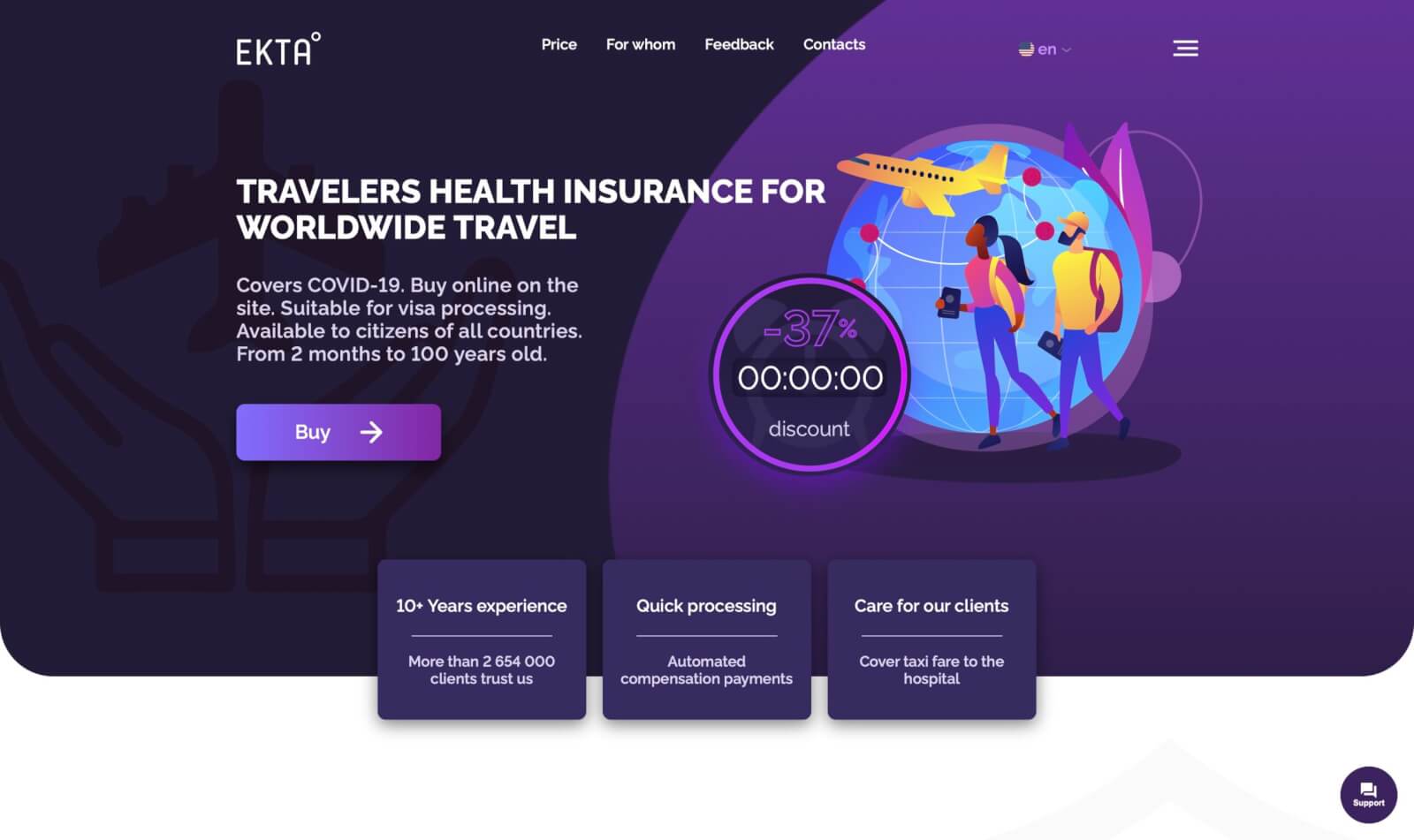

EKTA – A new generation travel insurance company that combines competitive prices with a high level of service.

Ekta is a travel insurance provider that offers a range of unique features and services. Here are some of the key features of Ekta:

Diverse Plan Options – Ekta offers different levels of coverage with their Start, Gold, and Max+ plans. These plans are designed to cater to a variety of travelers, from those on a budget to those who require comprehensive coverage for extreme sports and other activities.

Coverage for Active and Extreme Lifestyles – Ekta provides specialized coverage for active and extreme leisure activities and sports, which is often an add-on or not included in standard travel insurance policies.

Specific Coverage for Travel-Related Issues – Beyond basic medical coverage, their plans can include benefits such as:

– Baggage coverage: This includes compensation for lost or delayed baggage and even for the loss of documents.

– Equipment rental reimbursement: They offer reimbursement for the breakdown or damage of rented sports equipment.

– Flight delay coverage: The Max+ plan, for example, can cover expenses incurred from flight delays of over four hours.

– Legal assistance: Some plans provide coverage for legal assistance, including the payment of lawyer services and bail.

– Taxi fare to the hospital: A unique feature is the coverage for taxi fare to the hospital in case of an emergency.

Convenient and Fast Online Process – The process of purchasing a policy is simplified and can be done entirely online in a few quick steps. Customers can calculate the exact cost, pay, and receive their policy via email within minutes.

Worldwide Coverage and Accessibility – Their insurance is available for travelers worldwide and is suitable for a broad audience, including tourists, students, and business travelers. The policies are also valid all over the world.

– 24/7 Client Support: They offer round-the-clock customer service via phone, email, and live chat to assist clients with any concerns.

– No Alcohol Exclusion: A notable feature of the “Gold” plan is that it provides coverage even after alcohol consumption, which is often a major exclusion in many standard insurance policies.

– Automated Compensation: The company emphasizes quick processing and automated compensation payments, aiming for a streamlined and efficient claims process for their clients.